san mateo county tax collector property tax

1-877-829-4732 Operators do not accept payments email - taxmansdcountycagov. The division assesses over 221000 units on the.

County Of San Mateo California Selects Taxsys Pittsburgh Pa Grant Street Group

In accordance with California law the San Mateo County Tax Collector will commence the public auction of properties for which the taxes interest and fees have not been paid and continues from day to day until each property is sold to satisfy the taxes interest.

. Property Tax Account at 836 7TH AVE. Pay Transient Occupancy Tax. However you have until 500 pm.

The Tax Collectors office collected 306 billion exceeding the target of 3 billion for the fiscal year ended June 30 2021. San Francisco CA 94145-0878. Mail Tax Payments to.

The San Mateo County Treasurer and Tax Collectors Office is part of the San Mateo County Finance Department that encompasses all financial. The San Mateo County Treasurer-Tax Collectors Office located in Redwood California is responsible for financial transactions including issuing San Mateo County tax bills collecting personal and real property tax payments. 2019 2022 Grant Street Group.

Paid View Bill Bill Information. Make Tax Checks Payable to. The most recent increase in collections may in part be attributed to the increased dollar value of the secured tax roll and the divisions continued focus on.

Find other City Tax Office in Redwood City with. 2019 Secured Annual Bill 2019-331372. You may also go to our on.

382 DORADO WAY SOUTH SAN FRANCISCO CA 94080. Our success rate is 37 better than the San Mateo County California average. Sandie Arnott San Mateo County Tax Collector.

Add_circle_outline Add company add_circle_outline Add product. 2015 Secured Annual Bill 2015-305294. A successful appeal results in an average savings of 650.

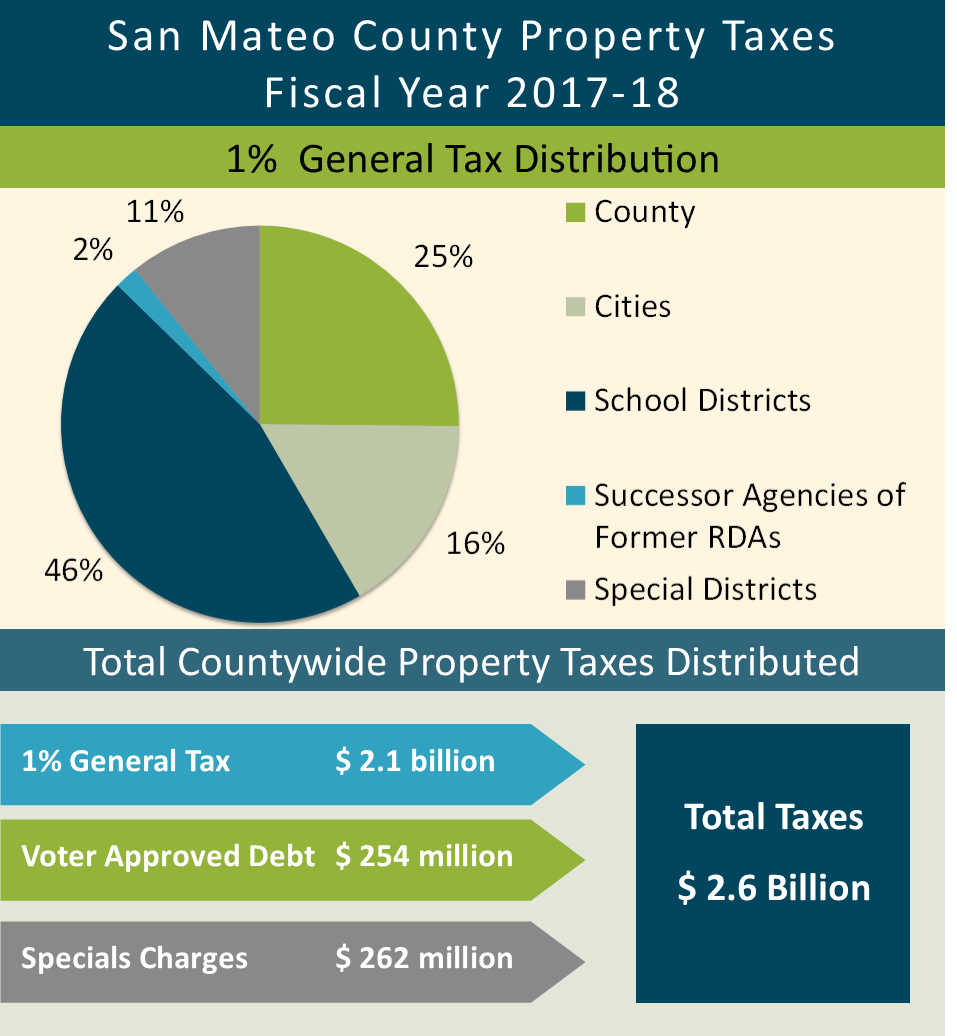

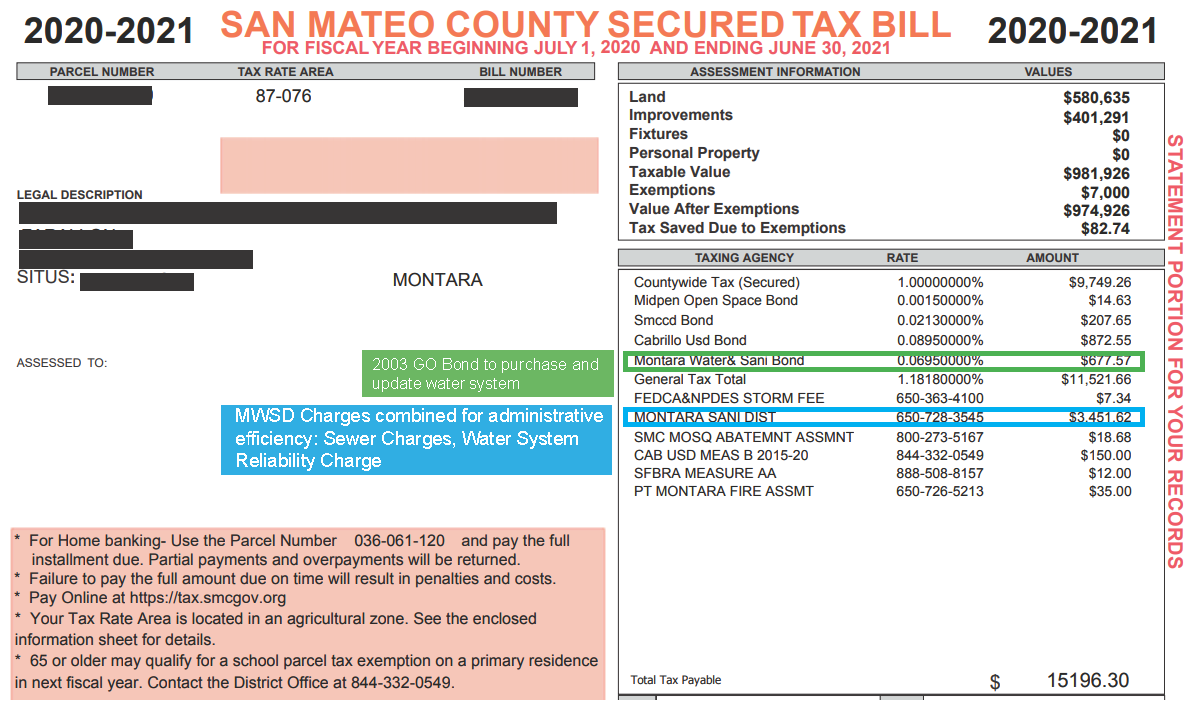

Countywide Tax Secured 100000000. 2019 Secured Annual Bill 2019-416541. If you did not receive a bill or if you recently purchased a property you may obtain a duplicate tax bill by calling 866 220-0308 or visiting our office.

Property Tax Account at 504 MONTEREY RD 9. 9 AM - 5 PM. The 1st installment is due and payable on November 1.

Paid View Bill Bill Information. San Mateo Countys average tax rate is 056 of assessed home values which is one of the highest in California. Property Tax Account at 507 ALAMEDA.

Typically property tax is 1 of the assessed value plus an amount to amortize voter-approved bonds and any fees for special assessments or charges such as mosquito abatement or sewer fees. Actual property tax assessments depend on a number of variables. Property Tax Account at 99 PARK LN 93-99.

Every year the Tax Collector mails the secured tax bills by November 1. San Mateo County Tax Collector. Of December 10th to make your payment before a 10 penalty is added to your.

San Mateo County secured property tax bill is payable in two installments. Total Ad Valorem Taxes 106470000. Center 1600 Pacific Hwy Room 162 San Diego CA 92101.

SSan Francisco Usd Bond. Announcements footer toggle 2019 2022 Grant Street Group. 9 AM - 5 PM.

Click here to start a live chat with Tax Collector staff. With a median home value of 784800 San Mateo County homeowners can expect to pay an average of 4424 a year in property taxes. Click here to start a live chat with Tax Collector staff.

Search and Pay Business License. Dan McAllister Treasurer-Tax Collector San Diego County Admin. Click here to start a live chat with Tax Collector staff.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in San Mateo County. Click here to start a live chat with Tax Collector staff. 2200 Broadway St Redwood City CA 94063 650 363-4142 Website.

The median property tax on a 78480000 house is 824040 in the United States. Account 013-124-010 382 DORADO WAY. Paid View Bill Bill Information.

Get San Mateo County Tax Collector rKaufman Lynd reviews rating hours phone number directions and more. Search and Pay Property Tax. Welcome to San Mateo County.

Contact the San Mateo County Tax Collectors Office to verify the time and location of the San Mateo County tax sale. Our research shows that the majority of people that appeal successfully reduce their property tax bill. Phone Hours are 9 AM - 5 PM Monday - Friday Excluding all Holidays.

Get website phone hours directions for San Mateo County Tax Collector County Center 555 Redwood City 1 6503634142.

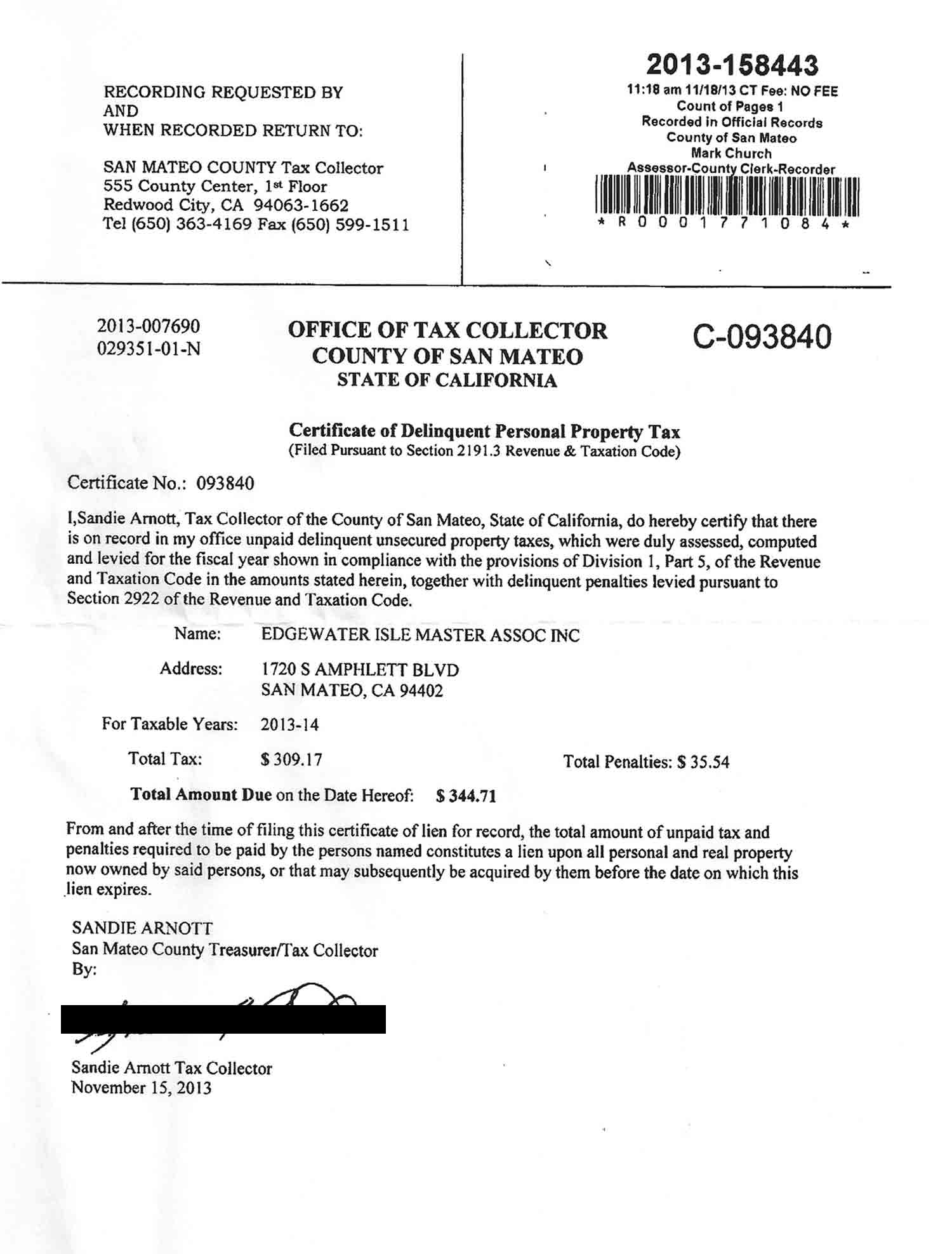

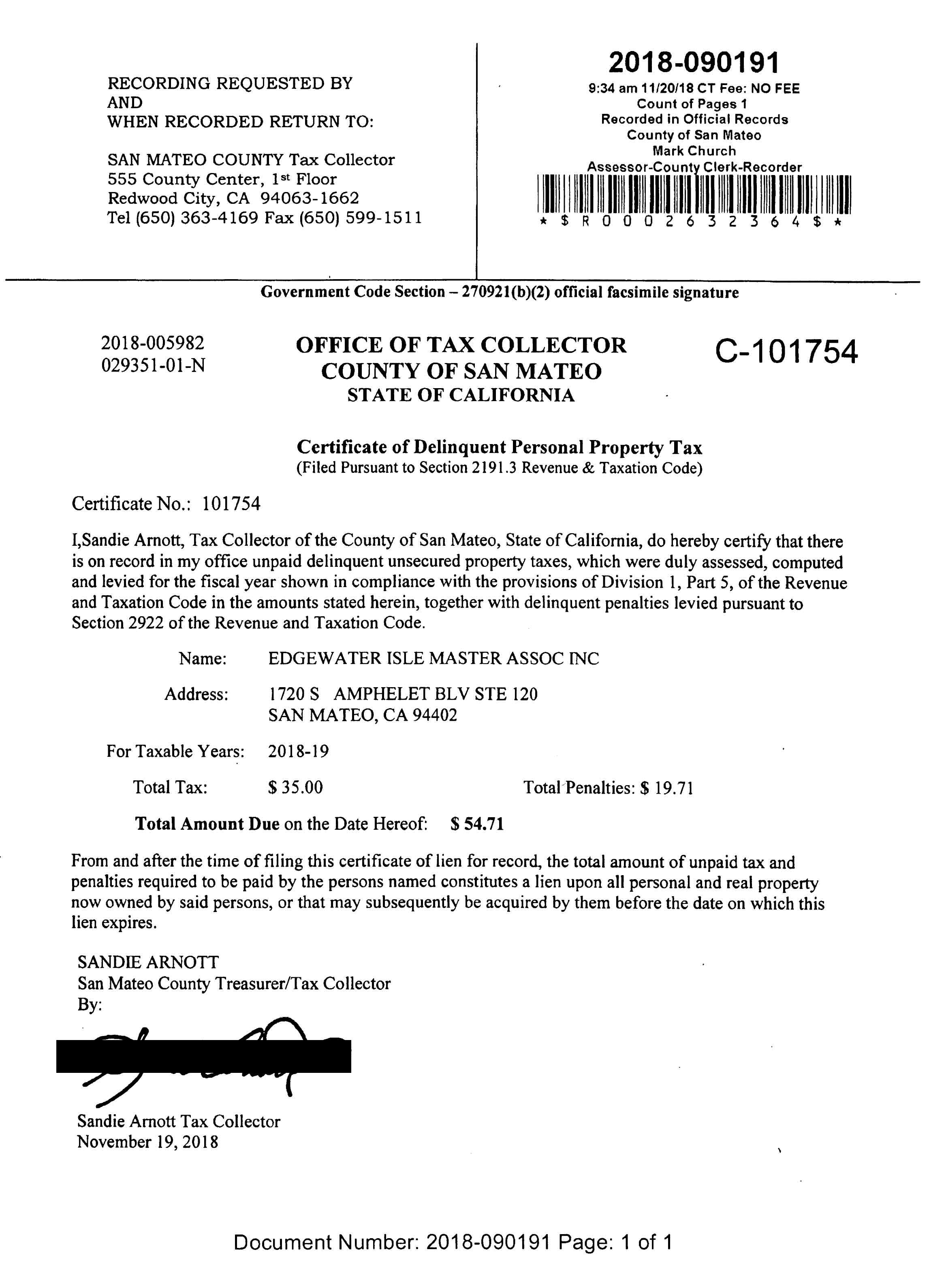

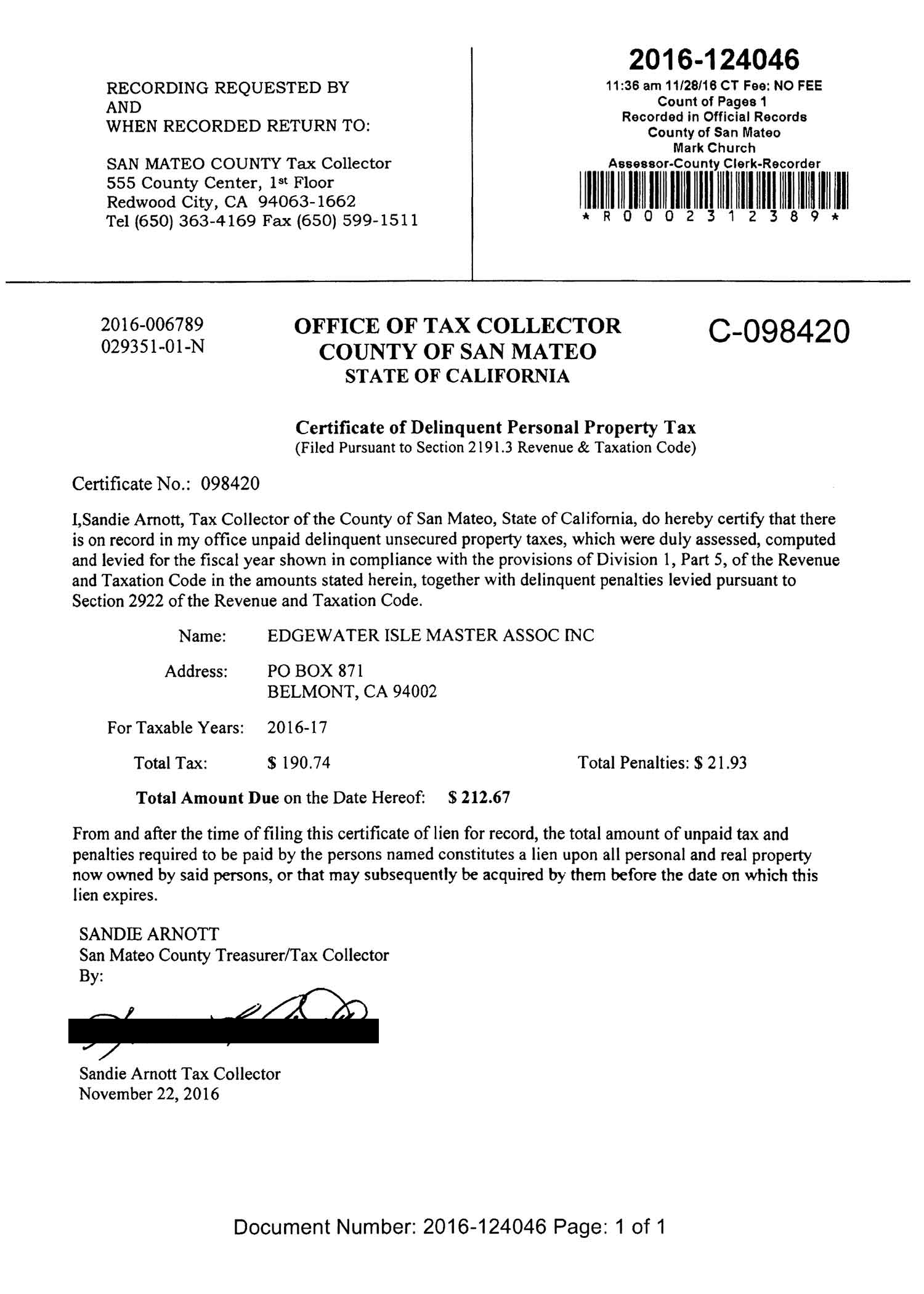

San Mateo County Issues Liens Against Master Association

Property Tax Search Taxsys San Mateo Treasurer Tax Collector

Pay Property Taxes Online County Of San Mateo Papergov

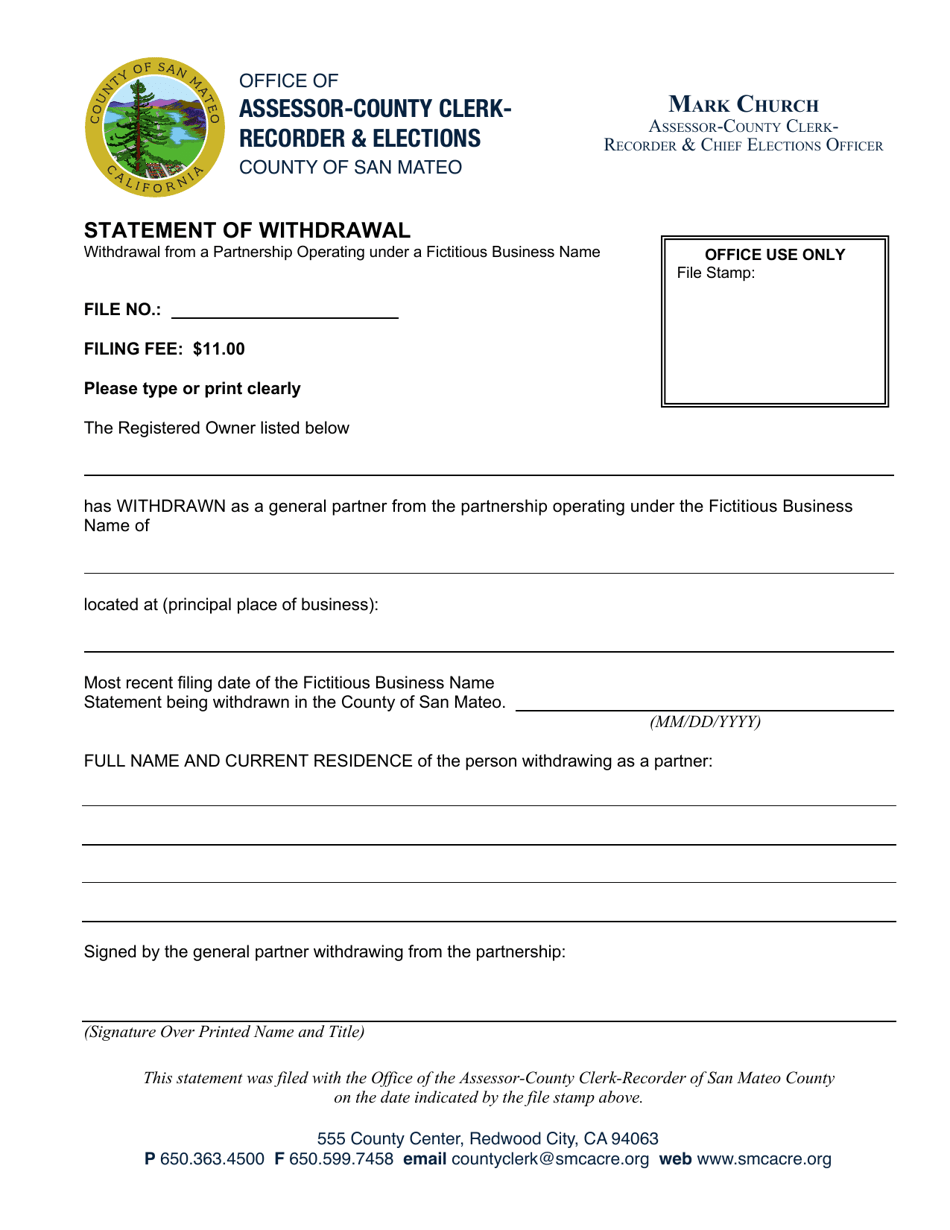

County Of San Mateo California Statement Of Withdrawal From A Partnership Operating Under A Fictitious Business Name Download Fillable Pdf Templateroller

County Controller Publishes Property Tax Highlights For Fy 2021 22 County Of San Mateo Ca

Sandie Arnott For Treasurer Tax Collector 2022 Pretty Proud Facebook

San Mateo County Ca Goes Live With Taxsys Business Wire

Controller Releases Property Tax Highlights Showing Seventh Year Of Growth Everything South City

San Mateo County Issues Liens Against Master Association

Charges On Property Tax Bill Montara Water Sanitary District