salt tax cap news

For example policymakers have proposed doubling the cap for married couples or making it more generous. 164b6 added by the TCJA for tax years 2018 through 2025 limits the itemized deductions for personal property taxes state or local taxes foreign taxes and state and local sales taxes in lieu of state and local income taxes to 10000 per year 5000 if married filing a separate return the SALT cap.

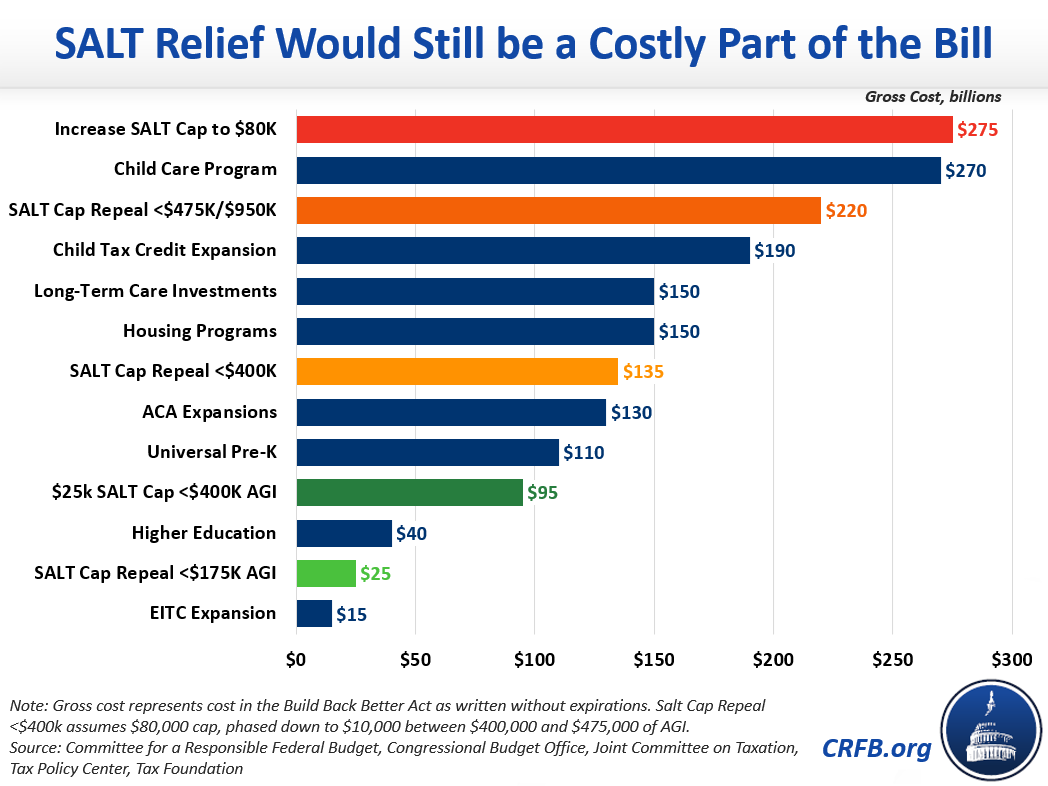

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before reinstating the 10000 limit in 2031.

. The trend among states to adopt elective pass-through entity taxes or PTETs emerged as a measure to decrease the impact of the SALT cap which was introduced under the 2017 Tax Cuts and Jobs Act. Since the SALT cap was put into place however very high earners have seen a sharp. Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation.

Joe Manchin D-WVa raised broader objections to President Bidens social spending and climate package. That was bad news for top earners in blue states such as California and New York. The current Democrat-controlled House passed a bill in 2021 that would temporarily raise the cap to 80000 until 2031 when it would go back to 10000.

Trumps 2017 tax cut capped the previously unlimited SALT deduction at 10000 hurting taxpayers who itemize their deductions especially those in high-tax states. According to the Tax Policy Center 16 of tax filers with income between 20000 and 50000 claimed the SALT deduction in 2017 compared to 76 for tax filers with income between 100000 and. The future of the SALT cap is uncertain creating additional planning challenges for pass-through business owners.

As Fox News reported the House passed legislation last year that would bring the cap up to 80000 until 2031 when it would be limited once again to 10000. While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over. The law caps a deduction for state and local taxes known as SALT at 10000.

The Internal Revenue Service IRS has provided data on state and local taxes paid and deducted for tax year 2018 the first year the SALT cap went into effect. However the bill stalled in December. Both Gottheimer and Suozzi have been some of the most vocal advocates for SALT playing a pivotal role in getting the language to increase the cap from 10000 to 80000 into the House-passed.

52 rows The deduction has a cap of 5000 if your filing status is married filing separately. 8 2022 145 AM. The lawsuit claimed that lawmakers crafted the provision to target Democratic states interfering with the states.

As alternatives to a full repeal of the cap lawmakers and experts have proposed a number of changes to the SALT deduction. In 2018 alone Californians paid an additional 112 billion in federal taxes because of the SALT Cap which translated into 55000 fewer jobs and a loss of 34 billion in wages. The SALT deal appeared to remove one obstacle to passing the sprawling 19 trillion spending plan.

The value of the SALT deduction as a percentage of adjusted gross income AGI tends to increase with a taxpayers income. The SALT cap has been debated by federal policy makers since its adoption. As adopted under the Tax Cuts and Jobs Act the cap is set to expire at the end of 2025.

August 9 2021 833 AM 3 min read. The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act a tax reform passed in 2017. D emocratic leadership outlined plans Monday to bypass GOP filibusters to alter the cap on deductions for state and local taxes paid a tax break largely for the wealthy opposed by most Republicans and some Democrats.

The 10000 cap was part of the 2017 tax overhaul and is set to expire at the end of 2025. But the Tax Cuts and Jobs Act limited that deduction to 10000. The SALT tax debate isnt going away anytime soon.

To help pay for that increase SALT deductions were capped at 10 000 per. Taxpayers can deduct up to 10000 of the state and local. A rollback of the cap on the state and local tax SALT deduction is on ice after Sen.

In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and 5000 for. The fiscal 2022 Senate Democratic budget proposal released on Monday calls for SALT cap relief. By keeping it for some taxpayers the lawmakers say their proposal would raise an estimated 1509.

The relaxed cap an increase from the current 10000 limit would last for a decade until 2031. In part one of a two-part series Baker Botts William Gorrod Renn Neilson Matthew Larsen Jon Feldhammer and Ali Foyt share how a. In 2017 during the Trump Administration the Tax Cuts and Jobs Act TCJA raised the amount of the standard deduction.

Paying a state income tax of 10 percent or more. This cap remains unchanged for your 2021 taxes and it will remain the same in 2022 if Congress doesnt remove the cap in its spending bill. The state and local tax deduction cap commonly known as SALT was enacted as part of President Donald Trumps 2017 tax reforms.

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Most New York Times Matt Dorfman Design Illustration Illustration Design Newspaper Design Health Magazine Layout

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Millionaire Sounds Off On Calls To Lift Salt Deduction Cap Itep

Free Download Real Estate Capitalization Rate Cap Rate Calculator For Excel Free Download With Sensitivity Matrix Mortgage Calculator Capitalization Rate Money Management Books

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

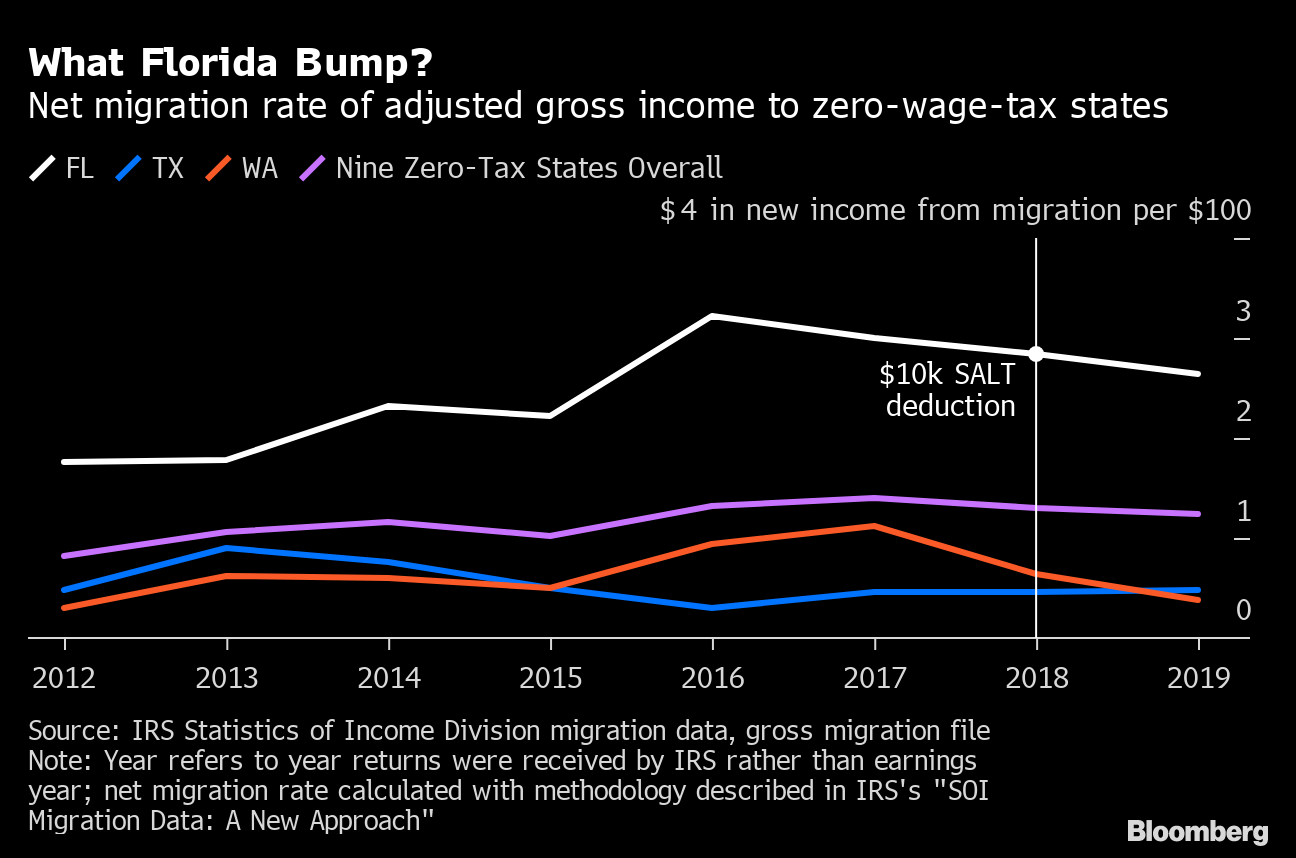

Salt Cap Confounds Doomsayers As Fears Of Exodus Prove Overblown Bloomberg

We Re No 51 Utah Last Again For Per Student Spending Tuition Vocational School Bloomberg Business

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

The Buried Boon To The Wealthy In The Democrats Tax Plan The Economist

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget